By Alan Coleman on 15 Apr 2020

The Weekly Online Economy Report - April 13th

We've analysed over 43 million website sessions and over €150 million euro in online revenue over the past 10 weeks (Mon-Sun), to compile a weekly report covering the previous week's movements in the online economy during the Covid19 crisis.

The first four weeks fell in February and were before the Covid19 crisis took hold. The next 6 weeks are from March into April when the crisis started to escalate. When we say 'last week' we are referring to Monday 6th - Sunday 12th of April. Here are last weeks figures:

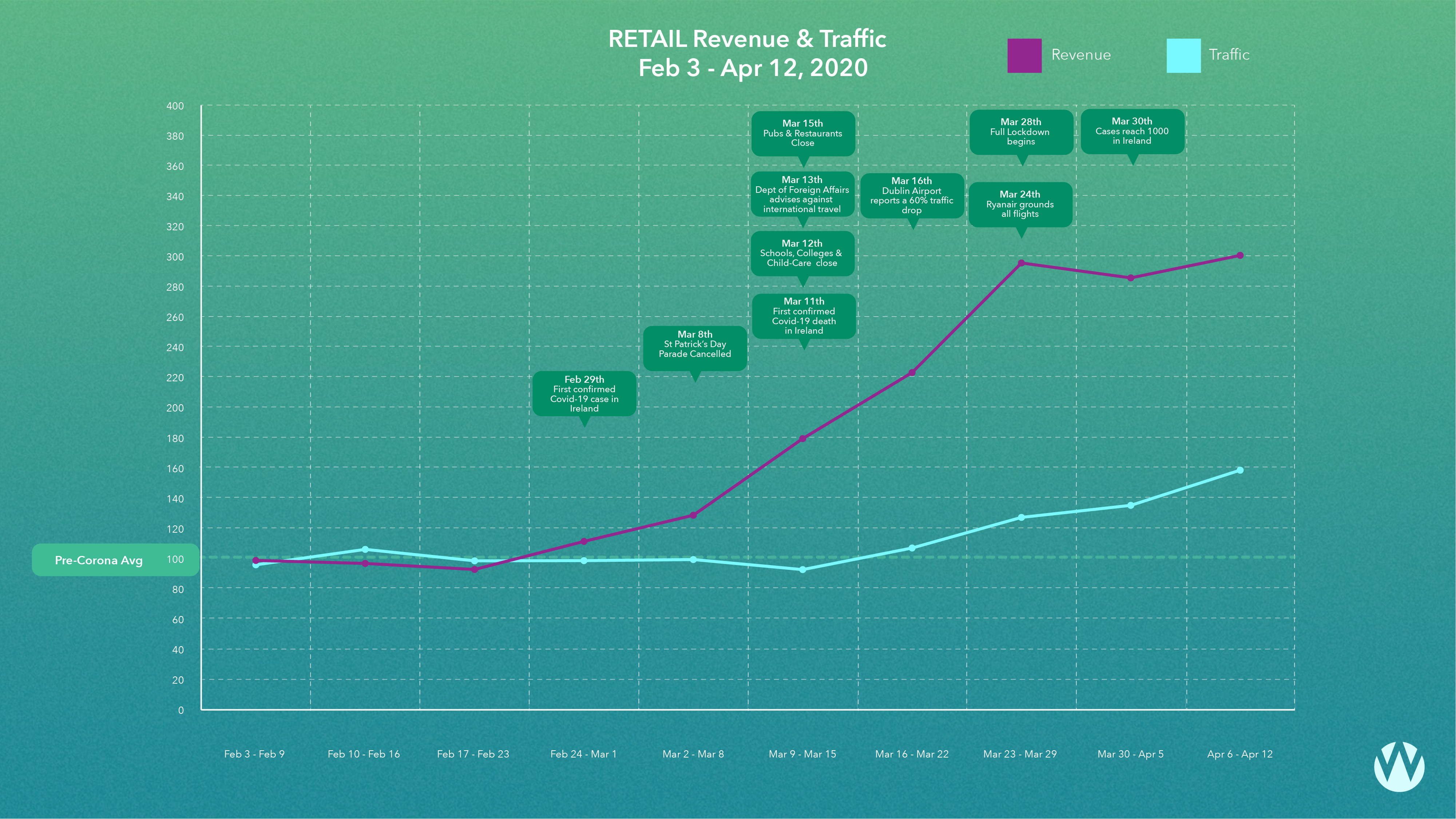

Retail

April week 2 saw a 58% increase in traffic on pre covid levels for online retailers. This is trending upwards.

Online revenues were up 200%, treble their pre-covid levels. This is trending upwards again. The majority of retailers who temporarily halted online orders for supply side reasons the previous week are operational again.

2020 is preparing to host “the summer of the garden party”. Last week saw pint glasses, sun loungers and trampolines flying off the shelves in advance of the sunny long weekend. It is expected restrictions on small gatherings will be among the first to be eased while restrictions on bars, restaurants and events among the last. This paints a picture of the nation enjoying vibrant “at home social activity” this spring and summer. We expect spend to follow consumers into their homes and gardens.

While home and garden hardware products are seeing dramatic increases in demand, it is important to note online stallworth fashion is not experiencing growth. Clothes and footwear categories are holding steady on pre-covid crisis levels with the exceptions of activewear and leisurewear which are growing.

The Enterprise Ireland recent COVID-19 Online Retail Scheme announcement also brings welcomed news to the industry. The support has a total fund size of €2m and supports a maximum of 80% of eligible costs with a maximum grant of €40,000 available.

Find out about Wolfgang’s Covid-10 Online Retail Scheme Packages designed to help get your retail operations back on track, including details on how you can apply.

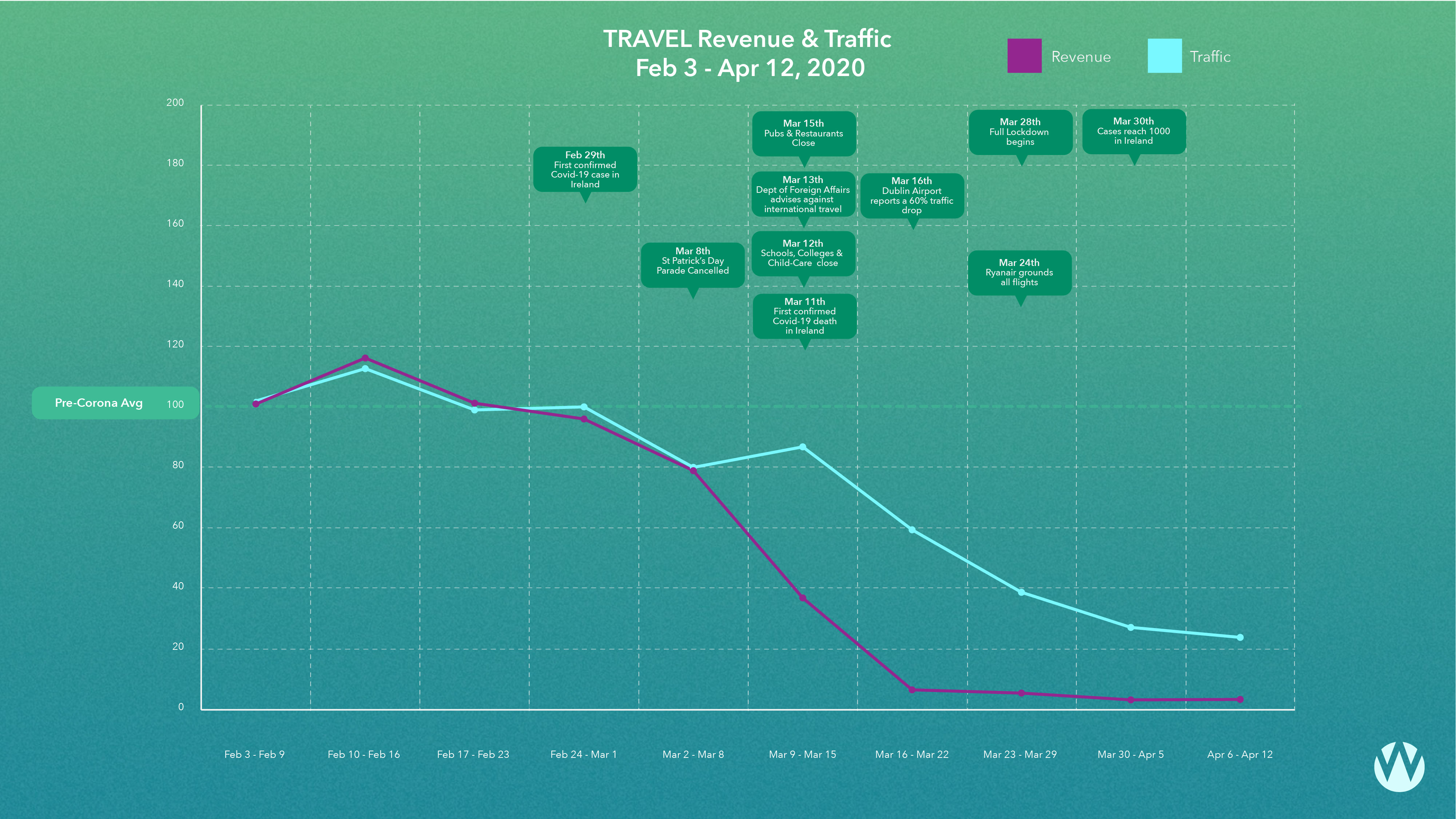

Travel

Last week’s traffic was down 76% on pre-covid levels. This continues to trend downwards. Last week’s online revenue was trending down by 97% of the February weekly average. This is now holding steady.

About the data

We have approximately 100 retail and travel e-commerce merchants of various sizes in the data set. We apportion each contributor equal weighting on the final figure regardless of the size of their traffic and revenue. The dataset is dynamic, we might add and we might lose participants over time.This may lead to slight variances in the figures as time passes.